Evaluation of the Quality of Banking Service Using the Kano Model: A Case Study in Ashur International Bank

DOI:

https://doi.org/10.51173/jt.v5i1.981Keywords:

Banking Service, Quality Service, Kano Model, Customer Needs and Requirements, Ashur International BankAbstract

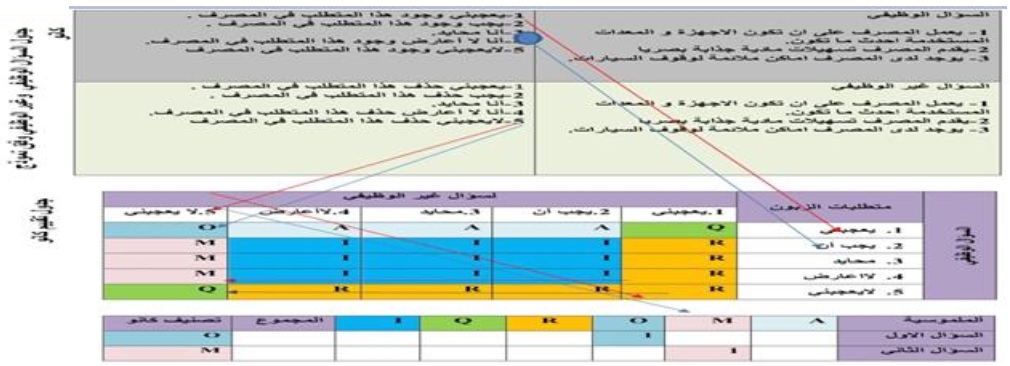

The Kano model is one of the necessary tools for classifying the customer's requirements according to their degree of importance. This research aims to know the needs and requirements of direct importance to the customer when evaluating the quality of the banking service provided, and then classify these requirements and using the Kano model into basic, attractive, one-dimensional and undistinguished requirements, in order to focus on the requirements of the most importance, as a sample for the study (70) questionnaires were distributed to the bank's customers to determine the requirements of the customer. I used the applied method determine what the customer requires. Statistical methods were used using (SPSS V.24; Microsoft Excel) and the most prominent results were that the classification of the quality of banking service according to the Kano model varies from one bank to another depending on the needs and requirements of the bank's customers. Knowing the needs and requirements of the customer from banking services is necessary for the success and survival of any bank.

Downloads

References

Nzumile, J. M., & Taifa, I. W. (2021), “Stratification Of Students’satisfaction Requirements Using The Kano Model”, Business Education Journal, 10(1).

Rotar, L. J., & Kozar, M. (2017),” The use of the Kano model to enhance customer satisfaction”, Organizacija, 50(4), 339-351.

Amin, M. (2016),” Internet banking service quality and its implication on e-customer satisfaction and e-customer loyalty”، International journal of bank marketing. https://doi.org/10.1108/IJBM-10-2014-0139

Aziban, Waheeb Mahdi, and Abu Bakr, Elham Ahmed, (2022), “The Role of Modern Public Relations Technologies in Improving Service Quality Case Study (Al-Kuraimi Bank) Republic of Yemen”, Journal of the College of Arts and Media, Misurata University, Volume (7), Issue ( 13), pp. 9-53.

Mahmoud, Azhar Ragheb, (2021), "The effect of the marketing mix on the quality of banking service, an exploratory analytical study of the opinions of a sample of customers of some private banks operating in Baghdad", Master's thesis, Administrative Technical College / Baghdad, Central Technical University.

Al-Sheikh, F.O., (2017), "The Impact of Software Quality Assurance on Incident Management of Information Technology Service Management (ITSM) A Field Study on Website’s Development Companies in Jordan", (Doctoral dissertation, Middle East University).

Boukreqia, Rafiqa and Zaabat, Sami, (2020), “The effect of adopting the dimensions of banking service quality in building customer loyalty - a sample study of private banks in the state of Jijel”, Journal of Strategy and Development, No. 1 bis (Part One), p. 140- 159

Shahraki, A. R. (2014), “Evaluation of customer satisfaction about Bank service quality”، Int. J. Industrial Mathematics، Vol. 6, No. 2.

Al-Tamimi, Hadeel Adel Taher, (2016), “Electronic banking techniques and their impact on the quality of banking service in a number of Iraqi private and governmental banks”, master’s degree in total quality management techniques, Administrative Technical College / Baghdad, Central Technical University

Neely, Elham, (2015), "The quality of banking service and its impact on customer satisfaction, a case study of commercial banks in the state of Constantine", Economic Visions magazine, Volume 5, Issue 1

Al-Slehat, Z. A. F. (2021), “ Determining the effect of banking service quality on customer loyalty using customer satisfaction as a mediating variable: An applied study on the Jordanian commercial banking sector”، International Business Research, 14(4), 1-58.

Vencataya, L., Pudaruth, S., Juwaheer, R., Dirpal, G., & Sumodhee, N. (2019), “Assessing the impact of service quality dimensions on customer satisfaction in commercial banks of Mauritius”، Studies in Business and Economics, 14(1), 259-270

Noureddine, Martani, (2021), “The impact of the quality of banking service on the performance of commercial banks: a field study at the Algerian Public Credit Bank (CPA) Guelma Agency, and the Bank for Agriculture and Rural Development (BADR) Guelma Agency”, Master’s thesis, 8 May University 1945 Guelma, Algeria

Rindani, F., & Puspitodjati, S. (2020), “ Integration of Webqual Method to Importance Performance Analysis and Kano Model to Analyze System Quality of E-Government: Case Study LAPOR!”، Jurnal Sistem Informasi, Vol.(16)، No.(2), pp1-17.

Madzík, P., Budaj, P., Mikuláš، D., & Zimon, D. (2019), " Application of the Kano Model for a Better Understanding of Customer Requirements in Higher Education-A Pilot Study", Administrative Sciences, Vol(9), No.(1)، pp. 1-18.

Abbas, A. K. (2017), “A Survey Using Kano Model and Road map to issues Standard Model of e-commerce Using SPLE technique”, Engineering & Technology Journal, Vol. (35), No. (2), pp. 132-143

Atlason, Reynir S., Giacalone, Davide (2018), "Rapid computation and visualization of data from Kano surveys in R”, BMC Research Notes, Vol.(11)، No.(1)

Shukla, M. K., Ranganath, M. S., & Chauhan, B. S. (2017), “ Integrated Kano model and QFD in designing passenger Car”، International Journal، Vol.(5), No.(2), pp.241-242.

Chen, M. C., Chang, K. C., Hsu, C. L., & Yang, I. C. (2011), “ Understanding the relationship between service convenience and customer satisfaction in home delivery by Kano model”، Asia Pacific Journal of Marketing and Logistics, Vol. 23 No. 3, pp. 386-410

Chen, M. C., Chang, K. C., Hsu, C. L., & Yang, I. C. (2011), “ Understanding the relationship between service convenience and customer satisfaction in home delivery by Kano model”، Asia Pacific Journal of Marketing and Logistics, Vol. 23 No. 3, pp. 386-410

Rizaldi, R. (2019), “ Measuring Client Satisfaction Level From Migration Manual Reconciliations system to Automatic Reconciliations system In Bank Danamon Indonesia Using Kano Model”, Journal of Applied Information, Communication and Technology,Vol.( 6)،No.(2),pp 55-60

Morsaghian, M., Zadeh, I. A., & Nobari, S. (2015), “ Providing a way to Recognize Bank Customers’ needs Effectively based on Clustering Techniques, the Fuzzy TOPSIS and Kano Model: A Case Study in Bank of Qarzollhassaneh Mehr Iran in Khuzestan”, Indian Journal of Science and Technology, Vol.(8), No.(27).

Loučanová, E., Nosálová, M., Parobek, J., & Dopico, A. (2018), “ The Kano model use to evaluate the perception of intelligent and active packaging of Slovak customers”، Studia Universitatis Vasile Goldiș Arad, Seria Științe Economice, 28(1), 35-45

Azka, R. D., & Nurcahyo, R. (2018), “ Quality management strategy for Indonesian aircraft MRO companies based on Kano Model, QFD matrix, and AHP”, In Proceedings of the International Conference on Industrial Engineering and Operations Management, ISSN(2169-8767)، pp. 1544-1555

Asian, S., Pool, J. K., Nazarpour, A., & Tabaeeian, R. A. (2019), “ On the importance of service performance and customer satisfaction in third-party logistics selection: an application of Kano model”، Benchmarking: An International Journal. http://www.emeraldinsight.com/1463-5771.htm.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dhuha Mohammed Mohammed Rashed, Azzam Abdulwahab Abdulkareem

This work is licensed under a Creative Commons Attribution 4.0 International License.